Next to delivering profits to their shareholders, companies are also increasingly expected to contribute to development needs, and pay taxes in the locations where they create added value. But at a time when the expectations of corporate stakeholders around the world are rising, corporate social responsibility (CSR), the bolt-on approach that is compliance driven, costs money, and produces limited reputational benefits is gradually losing its utility.

In South Africa, for example, many companies are legally mandated to comply with the Broad-Based Black Economic Empowerment Act 53 (2003) that seeks to reverse economic and social inequalities inherited from the Apartheid period by requiring that all stakeholders are appropriately considered in the internal operations and external stakeholder interactions of a company. This translates into preferential procurement policies to empower groups that had been previously disadvantaged, resulting e.g. in the active involvement of such groups in economic value creation via CSR initiatives.

Many firms, moreover, need to comply with the King Reports on Corporate Governance. The third report, published in 2010, brought the issues of sustainability and risk management to the fore, and requires all companies to adopt an “apply or explain” approach. Compliance with King III is mandatory for companies listed on the Johannesburg Stock Exchange, which typically translates to a firm dedicating one percent of post-tax profits to CSR projects. For example, Standard Bank (JSE: SBK), a South African financial institution with global revenues of ZAR 66 billion and ZAR 8.3 billion net income in fiscal year 2013, funds its Corporate Social Investment expenditure via an annual allocation of no less than one percent of the previous year’s after-tax income from its South African operations.

Raising impact and competitiveness by leveraging four megatrends

When they take citizenship commitments seriously, corporations find they are up against a seemingly endless ocean of need. For example, in the recently published World Economic Forum’s Global Information Technology Report, which assesses a countries’ readiness to benefit from emerging opportunities in information and communications technology, South Africa ranked 146th for its overall quality of education, before Yemen and Libya; it ranked at the bottom (148th) in terms of the quality of its math and science education.

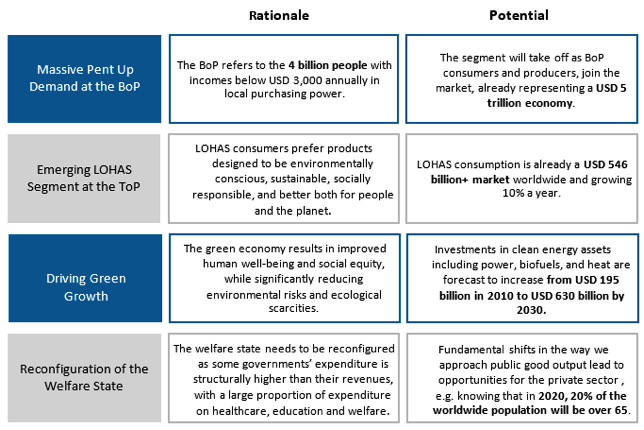

When companies regard the right balance between corporate responsibility and corporate opportunity, the overall transformation of the corporate value chain can help them deliver on both dimensions. Next to secular trends such as globalization and technical progress, four megatrends are creating new opportunities for profit and impact: (1) Growing demand for affordable products and services at the Base of the Pyramid (BoP), which is a 5 trillion dollar market opportunity; (2) People increasingly looking to gain meaning from their consumption, creating a virtuous consumer segment estimated at USD 546 billion globally; (3) The advent of green growth and the goal of a circular economy, which is creating, as just one example, a USD 700 billion cost-savings opportunity in fast moving consumer goods industries; and (4) A welfare state increasingly at odds with fiscal and demographic realities—with insufficient delivery of goods and services to cover fundamental basic needs being a particularly well-known challenge in South Africa.

Together, these trends are driving a reconsideration of the role of business in achieving financial, social and environmental goals (see graph below).

The way forward: marry corporate venture capital and impact

To future-proof profits and stay in business for the long haul, companies need to now find ways to derive economic value from the megatrends reshaping the economy and society in ways that are compatible with stakeholder expectations about corporate responsibility. Acting on the opportunity, however, has proven challenging for many. At a time when sustainability considerations loom ever larger for global CEOs, and in the minds of consumers and regulators, many executives report that they are stuck on their climb: the path to transformation is not yet readily discernable.

Impact Economy—the global impact investment and strategy firm—recently released “Driving Innovation through Corporate Impact Venturing: A Primer on Business Transformation” to help address this issue. Corporations invest in research and development; corporate venture capital has helped them over the past fifty years to capitalize on their profound industry expertise, moving from early insights into emerging trends to actual investments that yield the new products and services that can power core business.

The pursuit of impact is now being added to this formula: sustainability is increasingly driving value creation, and assessing joint opportunities for financial and social returns is gradually becoming the way forward. This new modus operandi, Corporate Impact Venturing (CIV), builds on the proven channel of corporate venture capital in order to source the innovations now needed. The advent of Corporate Impact Venturing is especially relevant for BoP consumers. The ranks of the disadvantaged will not diminish considerably anytime soon if we expect governments and development agencies to do the job alone. Novel affordable products and services, and jobs are also needed. Companies from emerging markets are in prime position to serve new customer segments due to proximity.

Anyone who wants to be successful needs to understand what matters to their customers, the business models that work in practice, how to make distribution happen, and how to become a trusted product and service provider—at the Base of the Pyramid and elsewhere. This typically requires the identification of pioneering business models and taking time to learn from implementation before attempting to scale.

Seeding the next generation of transformative business models

Leveraging core business competences can offer a powerful pathway to systematically engage in corporate opportunity without neglecting corporate responsibility. Consider, for example, Standard Bank’s AccessPoint model, which includes 3,900 AccessPoints across South Africa, with 37 percent owned by women. The AccessPoint model operates via installed facilities at local traders and spaza shops and takes banking to customers in the community, enabling them to do basic banking operations in a store and avoid the costs of traveling to a branch or ATM; the model processes around ZAR 5.3 million in transactions through small businesses partners (2013).

Globally, corporate venture capital invested USD 29.4 billion into 3,995 deals in 2013. Now imagine what would happen if companies diligently applied the corporate venture capital logic with impact considerations, strategically made investments in start-ups and spin-offs that were economically viable and created social impact, and if emerging market companies leveraged their locational advantage. As the pathways for sourcing business innovation are being updated, the pendulum is swinging to a new approach that reconciles corporate responsibility to include opportunity.

The time has come to welcome Corporate Impact Venturing, and get serious about building a promising sustainable future for everyone.

Maximilian Martin, Ph.D. is the founder and global managing director of Impact Economy, an impact investment and strategy firm based in Lausanne, Switzerland, and the author of the report “Driving Innovation through Corporate Impact Venturing.”