As social entrepreneurs continue to push the boundaries of capitalism and seek solutions to the world’s largest problems, Tom Bird offers this advice: “Build your ‘stone, sponge, crispness’ skillset.”

As social entrepreneurs continue to push the boundaries of capitalism and seek solutions to the world’s largest problems, Tom Bird offers this advice: “Build your ‘stone, sponge, crispness’ skillset.”

Bird elaborates on that skillset in the interview below, but it’s a repertoire that has served him well. From a career in technology to decades on the front lines of microfinance and impact investing, Bird has developed an eye for opportunity in a changing world. His real-world experience, coupled with an M.B.A. from Stanford’s Graduate School of Business (GSB) and a graduate degree from Harvard Divinity School, has helped him guide companies, mentor entrepreneurs and nonprofits and build a new breed of business leaders. Real Leaders had a chance to catch up with Bird recently after he had completed a section of the Camino de Santiago in Spain.

If you like this, subscribe here for more stories that Inspire The Future.

You are an 18-year veteran of impact investing. How did you get your start?

After building and selling a Silicon Valley records and information management business in the 90s, my wife and I moved to the Boston area with our young sons. Big changes were all around and I was open to saying yes to things that I might not have earlier. A college friend invited me to a holiday party for the pioneering venture philanthropy firm New Profit, and after hearing Wendy Kopp from Teach for America and others speak that night, I was instantly hooked on the idea that lessons learned from business could be intentionally applied for social and environmental good. Around that time, I enrolled in a Master of Theological Studies program, which opened up access to the banquet table that is Harvard University.

Over at the Kennedy School I took a class in Microfinance and started to compare and contrast venture philanthropy and what later came to be called impact investing by making grants to New Profit, and by adding a for profit investment in the microfinance firm MicroVest alongside my first investment in the social enterprise Care2. So, I started by being open, following my instincts to jump in, and then doing some critical analysis once I had some skin in the game with live projects to assess.

What was an early impact investment and what did you learn from it?

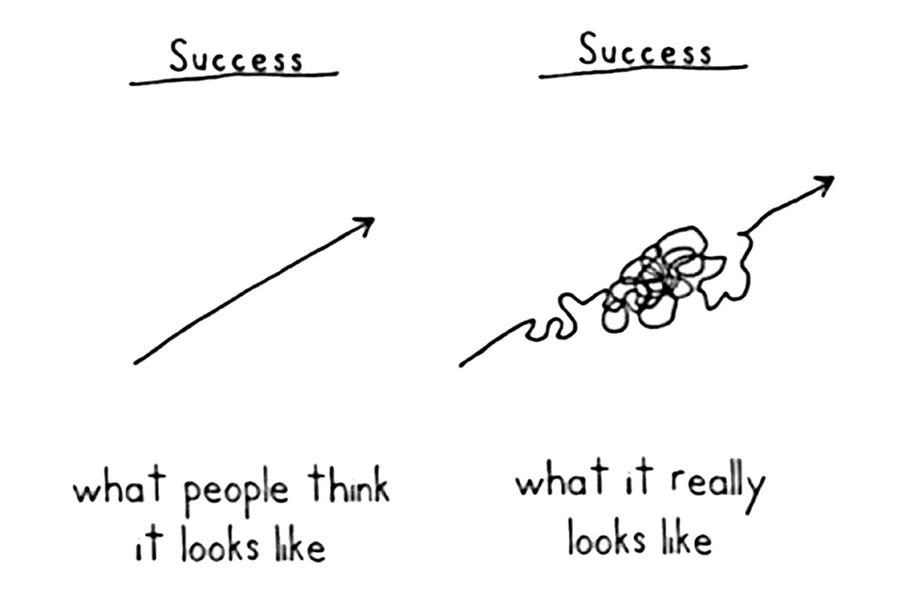

Back in 2007, I met the founders of d.light while they were finishing up at Stanford’s GSB, and we hit it off instantly. Their original vision around replacing kerosene in the developing world (with what was later called “off-grid solar solutions”) was bold, well thought out, and really resonated. But the thing that got me over the hump was an assessment of their chances to successfully execute. Fast-forward ten years and d.light has been a true star in the impact world. Awards galore, 80 million lives touched, etc. etc. What I learned from them is that impact business stardom involves a circuitous route. There have been fits and starts, twists and turns, and some pretty hairy moments along the way. Even for a firm of d.light’s quality, impact business building isn’t linear.

Tell us about the FARM Fund, your impact investing donor advised fund with ImpactAssets.

After several years of building a personal portfolio of seed stage impact investments, four Stanford GSB cronies approached me and said they liked what I was doing and wanted to help. They could see that the work was meaningful, but they all had full time gigs, and preferred to look over my shoulder rather than get too deep into the fray. So, the help offered was primarily in the form of adding cash rather than time. We agreed that financial returns did not need to accrue to us personally. The more we discussed the options, the more it became clear that the ImpactAssets donor advised fund product would be ideal to provide an administrative back end. Selective venture philanthropy projects could be supported (e.g. Global Giving Foundation) alongside the core impact investments. Portfolio financial returns would be available for recycling which created a sustainable flavor.

To manage the activities, we worked out a regular communications pattern with short quarterly written reports plus a “tracker” spreadsheet, and an annual dinner. The group has been able to keep a finger on the pulse of FARM, yet they are non-intrusive to the management efforts.

I’ll sometimes describe it this way: For an investor group that believes innovation and entrepreneurship can help meet global problems, the FARM Fund is a pooled, impact investment making, return recycling, donor advised fund, delivering blended returns unlike other vehicles that have a different feel and a significant toll.

You recently penned an article entitled, “A Dad’s Story: How I learned to stop worrying and love the blockchain” that highlights how you and your sons are looking at blockchain through an impact lens. What are you finding out about this emerging technology and its relationship to impact?

Centralized power structures are often corrupt and favor the overdog. The decentralization inherent in blockchain may turn out to level the playing field for the underdog, and that is something I find worth supporting. But blockchain and other emerging technologies are pretty tough to understand for an older guy like me, so I need help. My 25- and 27-year-old sons are patiently teaching me (while sometimes pulling their hair out at my ignorance).

One concept you are exploring is “succession.” With 18 years of experience, how do you pass on your knowledge of impact investing—whether to sons who have taught you about blockchain, or colleagues toe-dipping into impact investing?

For a couple of years now I have been thinking of FARM as a “greenhouse.” We’ve experimented and grown some things. The time has come to share “cuttings” to accelerate and provide leverage for others who want to come off the sidelines. The cuttings can be in financial or intellectual capital form. My hope is that those who run with the cuttings will add their own unique capabilities and far surpass what we have been able to accomplish with the original experiments.

With your unique background in business, Silicon Valley and impact investing what’s the best advice you could give successful entrepreneurs who are looking to harness the power of business to generate a measurable, beneficial social or environmental impact alongside a financial return?

Continue to build your “stone, sponge, crispness” skillset. Stone as in relentlessness, grit, unstoppability which requires a clear understanding of your own motives. Sponge as in drink in vigorously but squeeze out the excess that you can’t use. And be crisp in how you articulate the numbers. Just because you are doing good doesn’t mean you can be exempt from deeply understanding and communicating the math.

If you like this, subscribe here for more stories that Inspire The Future.