Cutting-edge nanotechnology helps combat food insecurity by producing higher yields and healthier crops.

By Real Leaders

Nano-Yield is a pioneering force in the world of nanotechnology, pushing the boundaries of what’s possible at the nanoscale since 2014. Nano-Yield leverages research and nano solutions to bring its patented nanotechnology to growers worldwide in the agriculture and turf industries.

“Our goal is to improve fertilizer and other crop input delivery systems to produce more food and create faster and more yielding harvests while requiring less energy, saving water, and greatly reducing overall environmental impact,” CEO and co-founder Clark T. Bell says. “We’ll do this using innovative and patent-protected nanotechnology, which offers a more precise, efficient, and eco-friendly approach to feeding our crops. Best of all, nanoparticles don’t create harmful side effects in our soil.”

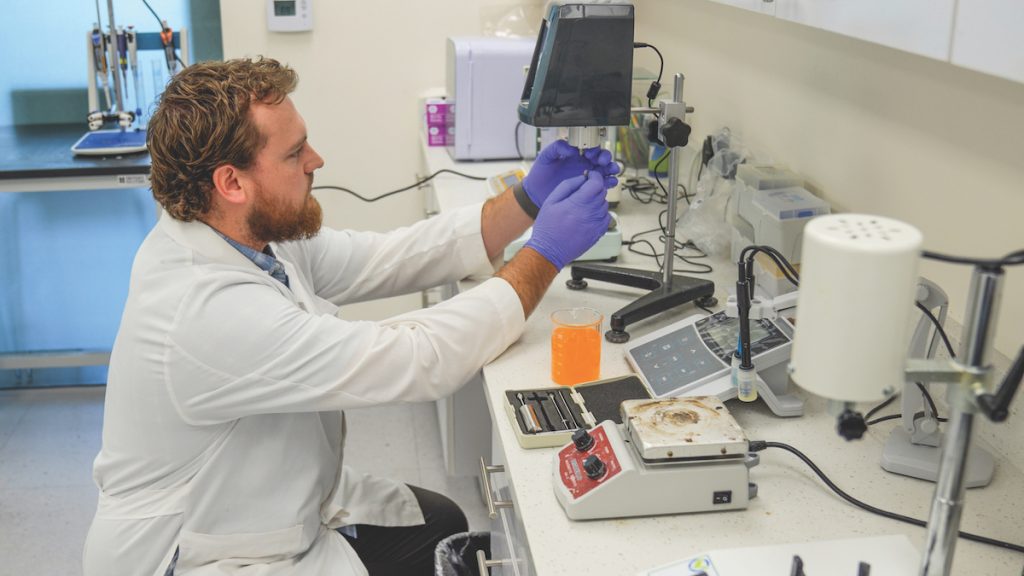

Nanoliquid technology is a cutting-edge technology that delivers nutrients or crop protection more efficiently into the plant either through root or foliar uptake. Nano-Yield has engineered different nanoparticles to optimize chemistry and nutrition to maximize delivery to the plant.

Family Roots

T.H. Bell planted the seeds for Nano-Yield in 1979 when he bought 40 acres of sagebrush in Utah County so his sons could turn it into a sod farm and earn money for college and church missions. Warren Bell gradually built the family farm into a successful business, studying agriculture, improving the farm’s infrastructure, and expanding its operations.

Eventually, Warren’s son, Clark, took an interest in the family’s sod business too. Clark heard that a friend was using nanotechnology to enhance his dry-cleaning business and wondered if nanoparticles could improve farm production. The trials Warren conducted saw significant improvement over industry standards.

Growing the Company

From there, Warren and Clark met Fraser and Mike Bullock, investors who are passionate about backing science-based companies. Together, they incorporated Aqua-Yield and formed an investor group, including sod growers from Australia, Canada, Norway, and South Africa. The company filed its first patent and discovered new liquid nano applications for agriculture.

Making key hires has been pivotal in the company’s growth. Landon Bunderson has steered research and development, making significant discoveries and helping the company file additional patents. Hiring industry experts in sales and operations has been another important factor.

Nano-Yield is now the leading nanoliquid company for agricultural production worldwide, located in 50 states and 22 countries covering 10.89 million acres, and holding eight U.S. patents.

How it Works

Nano-Yield nanoliquid technology works as a delivery system for crop inputs and is designed to deliver more of the crop inputs needed for maximum yield. While most nutrients enter the plant cell wall through diffusion or active transport, the nanoliquid particle loads the molecules and then bulk transports them through the wall by endocystosis. Nanoliquid products are highly compatible with fertilizers, biostimulants, and pesticide products. The increased product performance provided by nanoliquid products results in higher yields and healthier crops, engineered for driving nutrition into the plant. Once loaded, these technologies are ready to deliver your fertilizer to the plant via endocytosis.

Growers who add nanoliquid products with every application experience improvements in crop yield and quality, as well as improved control of weeds, diseases, and insect pests. They report an ROI starting at 3:1 and much higher in many cases. Proven through over 800 field trials and real worldwide farmer applications, this technology can cut fertilizer applications almost in half.

The Latest

Nano-Yield announced in April 2024 that to make its line of nanoparticle-based products more readily available to farmers nationwide, it partnered with WestLink Ag Group to distribute all company products through WestLink’s 42 retail outlets. The WestLink Ag partnership is the largest retail agreement for Nano-Yield in the continental United States.

In other news, Nano-Yield is entering into its first collaboration with a global fertilizer company. Nano-Yield will supply COMPO EXPERT Mexico with several patented nano-based crop nutrition products to increase the efficiency of COMPO EXPERT’s liquid and dry products, ultimately enhancing nutrient delivery to specialty crops and row crops in Latin America.

The company ranked No. 8 on the 2024 Real Leaders Top Impact Companies list.