Recently Apple sent their employees a letter asking them to come back to work at the office three days a week in late May 2022 (now delayed due to COVID resurging in the Bay Area, but employees must continue to work at the office two days a week).

It is a seemingly reasonable request, and as part of the plan, employees can work fully remote for “up to four weeks a year.” A group of current and former Apple employees called “Apple Together” are protesting the company’s new policy, and sent an open letter to company leadership demanding more flexibility.

What can business leaders learn from this Apple employee response about their role and the best ways to manage organizations?

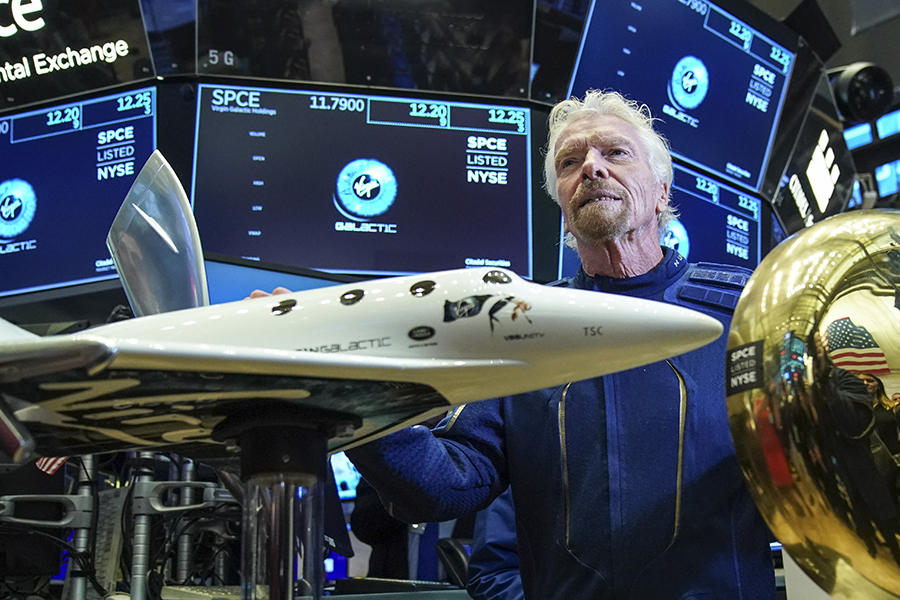

As a successful software company founder and business consultant for 30+ years, this type of employee reaction was unthinkable. The leaders in charge would have considered this change not as a request, but something employees should accept as a standard policy or find another job (what Netflix said to employees when they recently announced their new content policy).

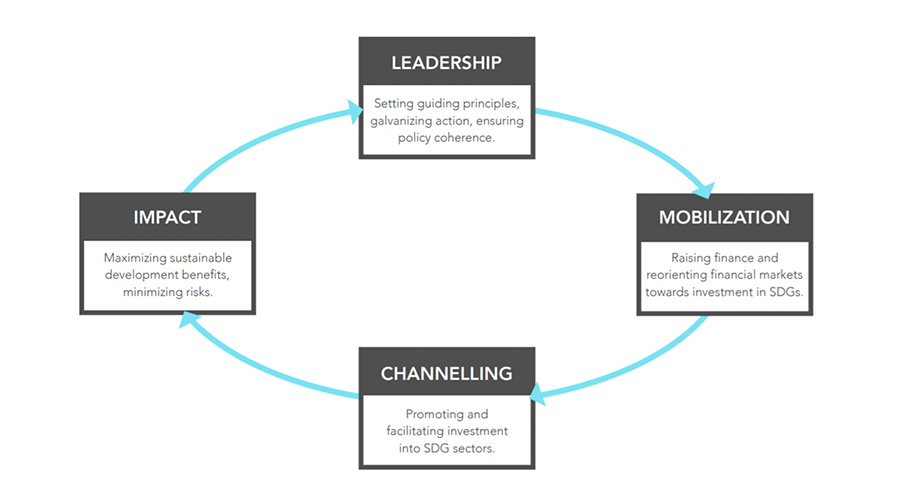

Executives should reflect on their roles today as organizational leaders and answer the question clearly…Who is really running their organizations? Judging by the declining levels of customer service at most companies, the customer is no longer the most important factor in establishing goals and policies…it is the employees. How did this happen? How did we get to a place where the executives at Apple are “begging” their employees to come back to work?

There are several drivers of this mind shift. Perhaps the chief cause is a break down in the relationship between leaders and followers. Today, the employees are given powers that traditionally were reserved for leaders. It seems that a generation raised by parents who catered to their Millennial offspring seem to think they have executive powers. I am not blaming the Millennials. Yes, many are entitled and lazy… so are many Baby Boomers. I blame the adults. Throughout my career, I hired, managed and worked with hundreds of Millennials (Gen Y)…including my daughter. And they are not all lazy and entitled as many Baby Boomers think.

But there is a large and influential percentage of this 26-41 year-old generation (born between 1981 and 1996)that somehow never got the message that they are not the boss of everything. The problem, however; is that this group has been conditioned by parents to believe they are equal decision makers. Parents abdicated their role as experienced decision-makers to those completely lacking in any life experience, which can unfairly set the children up to fail.

As a result, we have the employees at Apple telling the executives that they are not coming back to work, and leaders are not clearly saying no. Why? Parents and business leaders should really be making firm decisions based on their vast experience and responsibility levels (personal and financial), and communicate the new policy like Netflix did recently.

If Apple’s leadership team caves to their employees, it will be a recipe for organization mistrust. Traditional and working relationship of leaders and followers will be unproductively turned on its’ head.

In my experience, most people, including Millennials, want to go to work, receive direction from a boss, master new skills, and meet expectations set by the organization to move both the individual and team forward. It is incumbent upon leaders to define the organization structure, decision-making authority, and goals with roles and responsibilities clearly defined. This process is how trust is built, respect is created and productivity and fairness can create more wins for everyone.

Yes, times have changed, but human nature really has not. The “old-school methods” which I practiced as a parent and as a leader were simple. In general, people want to do well. They want to feel like their work is important, and their boss cares about their success. They want feedback, and to grow by learning from their leaders. Being a parent or business executive comes with great responsibility to create a culture of dignity and respect, which includes knowing when to say no.

If you want respect as a leader, listen to your team. Put yourself in their shoes in achieving the goals and expectations. I’ve discovered too often that what managers think takes ten hours to perform an assignment may in reality take 100 hours because of lack of clarity, resources, systems and team play. If a leader asks questions, the differences in expectations can be addressed to make real change, create real learning and ultimately build trust.

Clear communications by leaders ensures success for a team, company, society and a family working together. When my brilliant daughter was 7 years old, she informed me that I was not the boss of her. As a single dad, I explained to her very nicely and logically that I was for now. Years later, I hired her at my Aspire Software company, and she was one of our best employees. She now works elsewhere, and is highly effective and respected.

Based on what I was taught by bosses, expecting more from your employees makes the good ones feel valued and challenged. Isn’t this what we want as managers? Someone must be the boss or the organization will be held back by mistrust and lack of honesty that are essential to learn and perform.

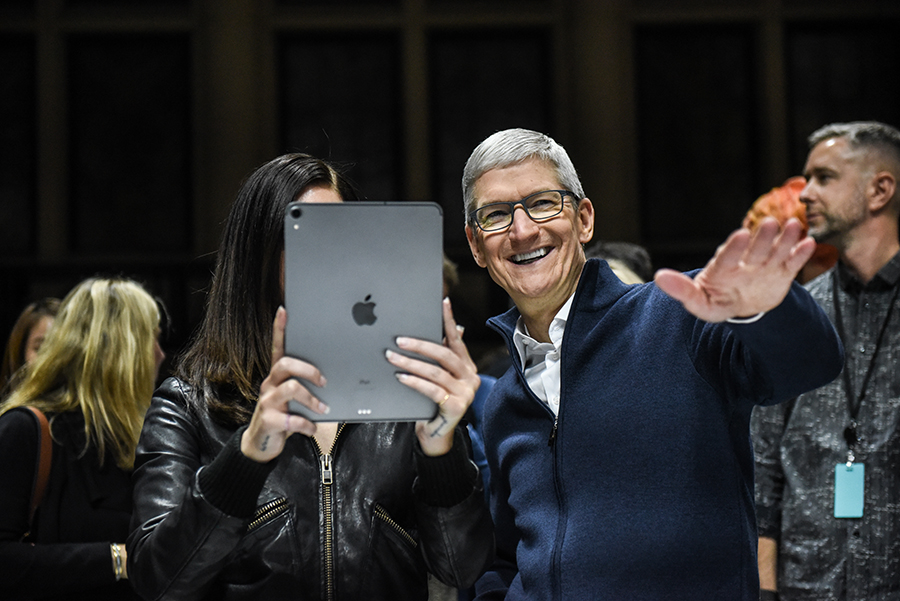

What would you do if you were Tim Cook or a leader at Apple managing this pushback?